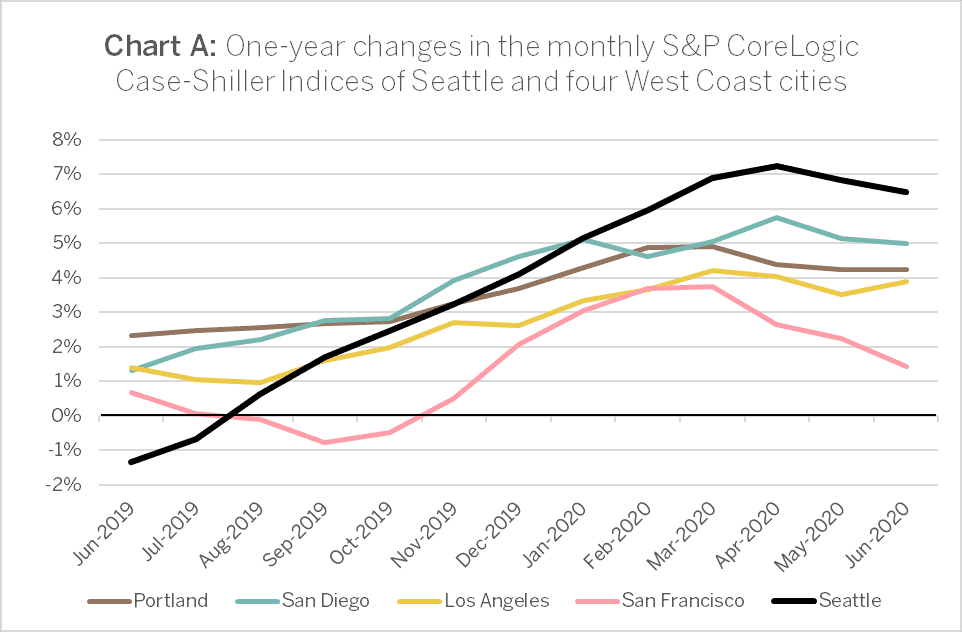

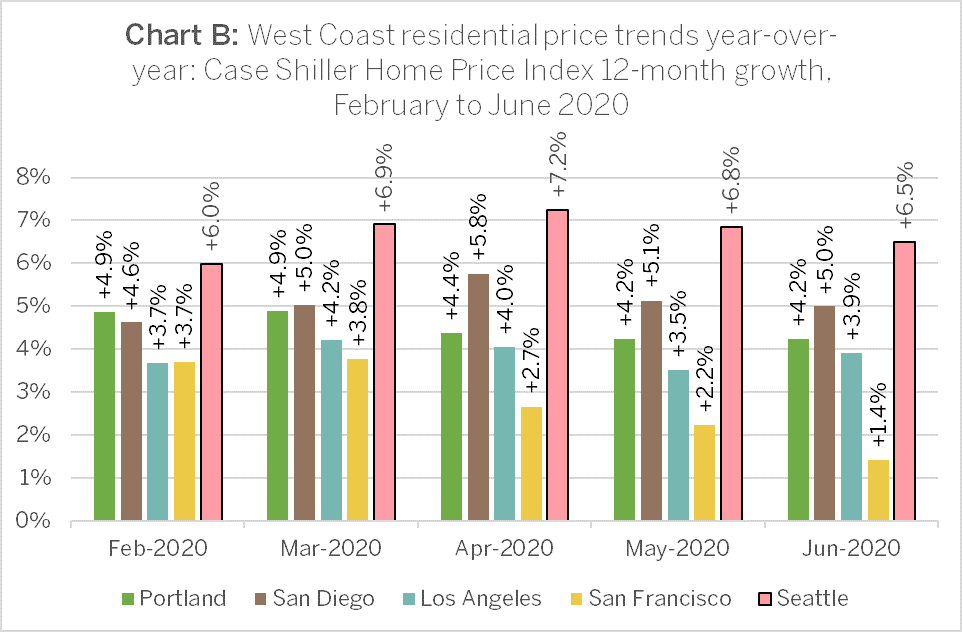

The CoreLogic Case-Shiller Home Price Index results published by S&P Dow Jones on August 25 showed a 12-month index increase of 6.5 percent for the Seattle MSA, marking the second month of slightly slower growth as commonly seen when summer approaches. (The index for Phoenix again reported 9.0 percent growth over the same period.) As at Seattle, residential price growth moderated in San Diego, while holding steady in Portland and slightly accelerating in Los Angeles.

Prices slowed more sharply in San Francisco, to 1.4 percent year over year in June, from 2.2 percent year over year in May. According to Zillow, home listing inventory in the city rose by 96 percent year over year. Skepticism greeted speculation that COVID-19 restrictions on retail businesses or teleworking allowances for employees were to blame, as these conditions likewise affected other high-tech cities (e.g., San José and Seattle) that saw no similar surges in inventory. San Francisco’s growth on the Case-Shiller Index has trailed that of Seattle for ten months.

Normalization is underway in both urban and rural counties

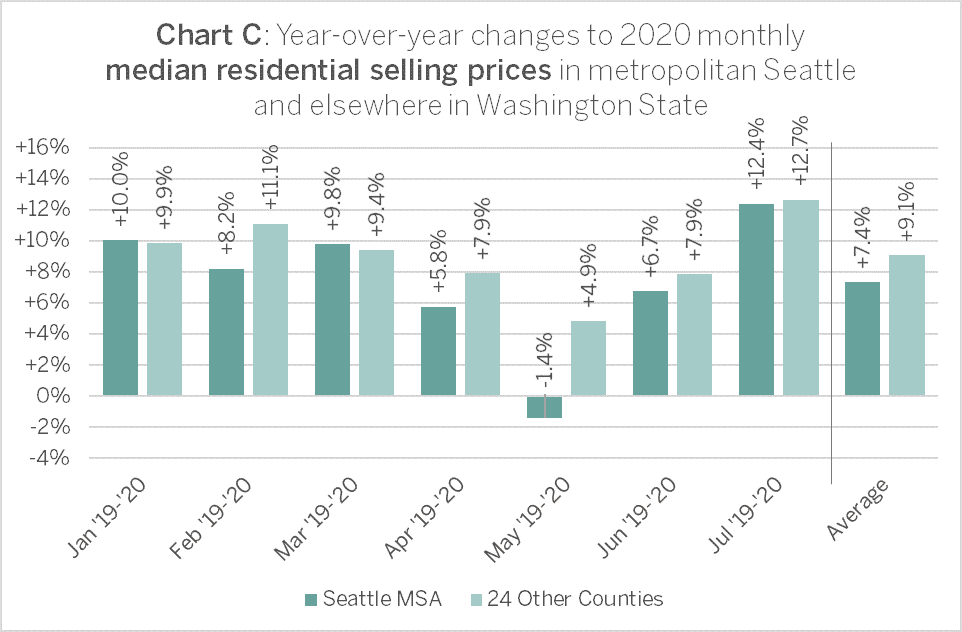

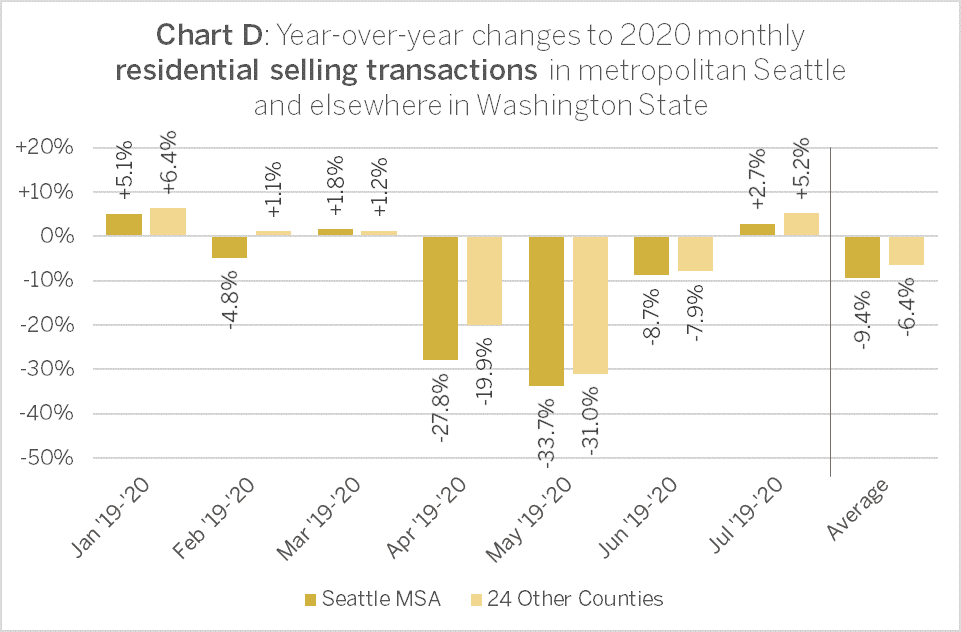

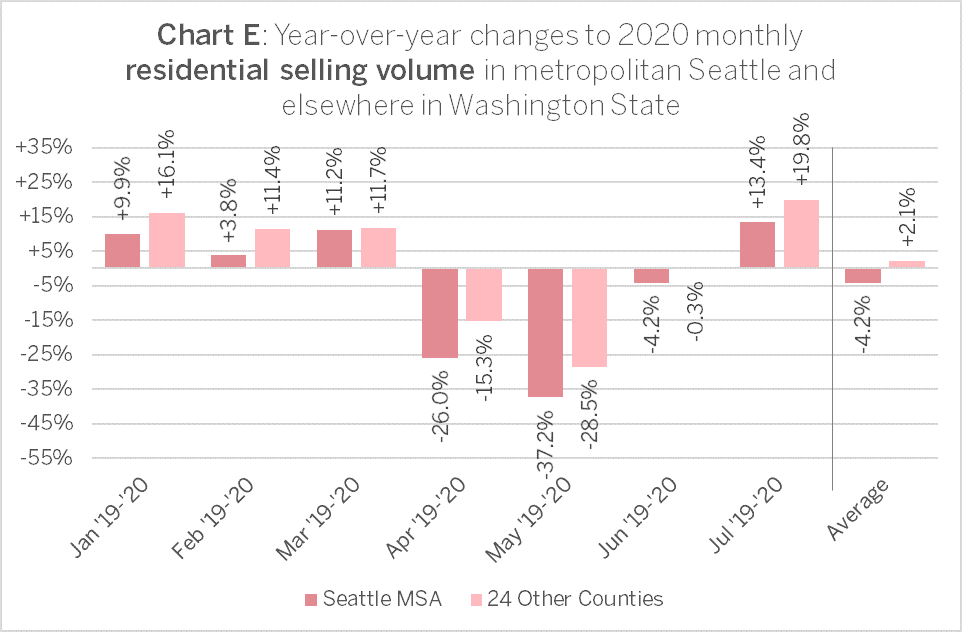

Data from the Northwestern Multiple Listing Service (“NWMLS”), which did not exclude sales of newly constructed homes, showed slightly different results for residential sales inside the Seattle MSA, and those sold in the other 24 counties participating in the listing service. These data show a shallow decline in the Seattle MSA’s median selling price in May, followed by a recovery in June. Outside the metropolitan region, the median price trend remained positive, and growth outperformed the urban region from April through July. (See Chart C.) The upturn in urban prices coincided with slackening year-over-year declines in the numbers of selling transactions. These were seen both inside and outside of the city from April through June and had completely reversed by July (Chart D). Thanks to higher prices, dollar-denominated selling volumes were higher as well (Chart E).

While not indicating the degree of flight from the city seen in San Francisco, these recent trends do show a slightly faster turnaround in exurban and rural markets. Do these trends mean that prospective home buyers and sellers have acquiesced to never-ending restrictions? Most likely not. Although not all market participants enjoy the luxury of time, many could wait for more favorable conditions to buy or sell, if only those were in view.

Yet low-interest rates in the here and now are among the conditions that have prompted some buyers and sellers to avoid further delay and jump into this market. Freddie Mac reports that home lending rates have crept back up to 2.99 percent, though still near historical lows.

Exurban inventories are nearly as tight as those in the city

However, low inventories of homes for sale comprise the one key market factor that has inhibited more home buyers from taking advantage of the low rates and scant competition. Coincidentally, the inventory bottleneck has inhibited buyers whose professions allow them to work remotely. Under current restrictions, some prospective buyers might have preferred to relocate further out, but have been unable to find suitable homes to buy in more remote locations. The selling transaction data suggest that these would-be buyers chose not to exit the region as did many from San Francisco. Not wishing to separate from their current employers or clients, and with comparatively more options available in King, Pierce, and Snohomish Counties, most of them either stayed put or simply moved across town.

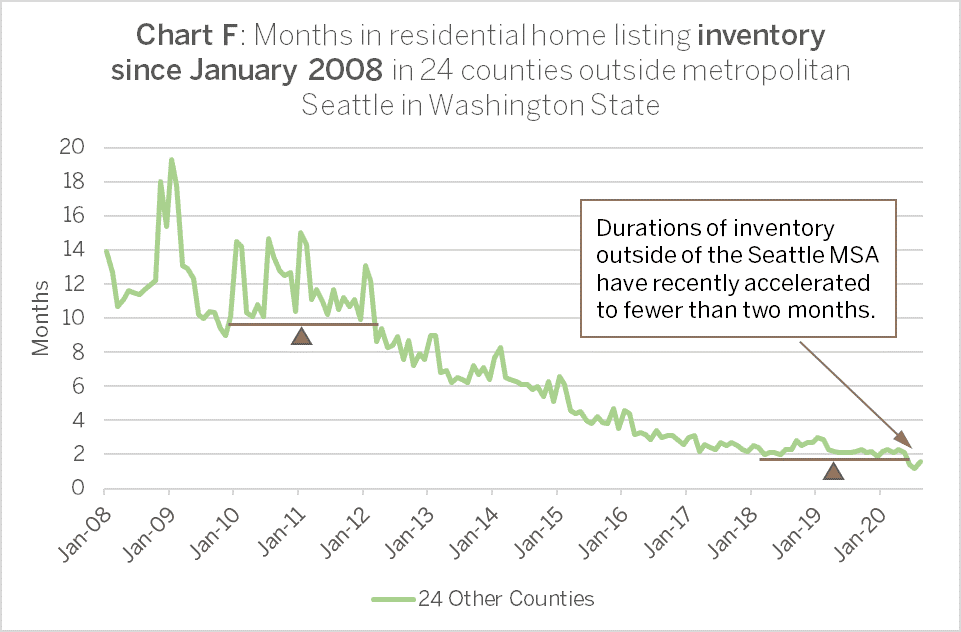

The shortage of homes in the city of Seattle dominated the news in 2018 and ’19; but remarkably, the trend among exurban and rural markets has been far more long-lived and acute in its effects on the local availability of homes (Chart F).

Throughout the region at the end of the subprime crisis a decade ago, baseline durations of home listing inventory were set from 2010 through 2011: about six months in the Central Puget Sound, and ten months across the 24 remaining counties covered by the NWMLS. As the market recovered and then boomed over the next six years, these durations steadily accelerated to averages of six weeks in the Seattle MSA, and ten weeks in the other two dozen counties. Commuters “driving to affordability” drew down the housing stock in towns from the Canadian border to Oregon.

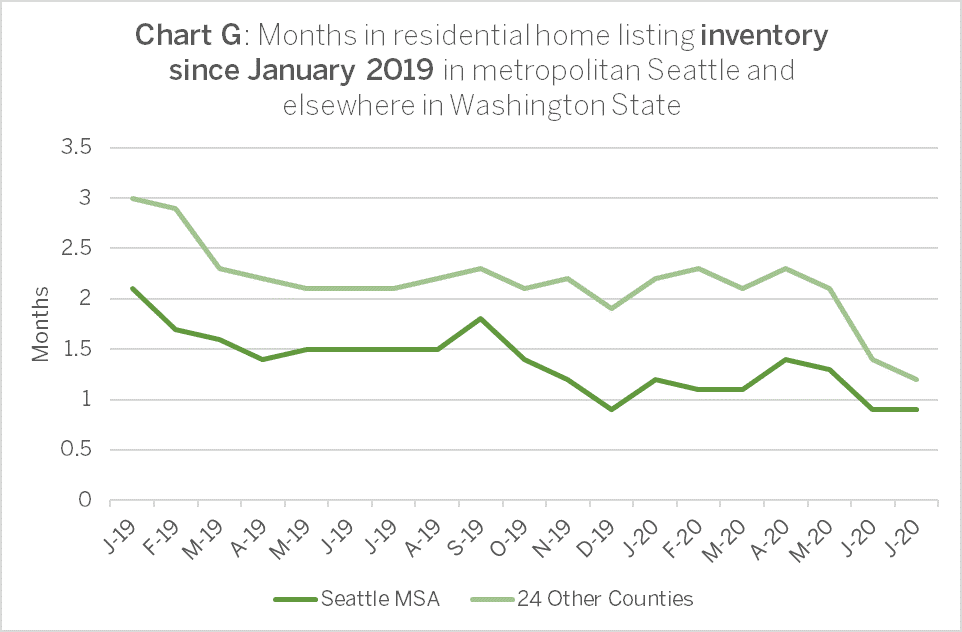

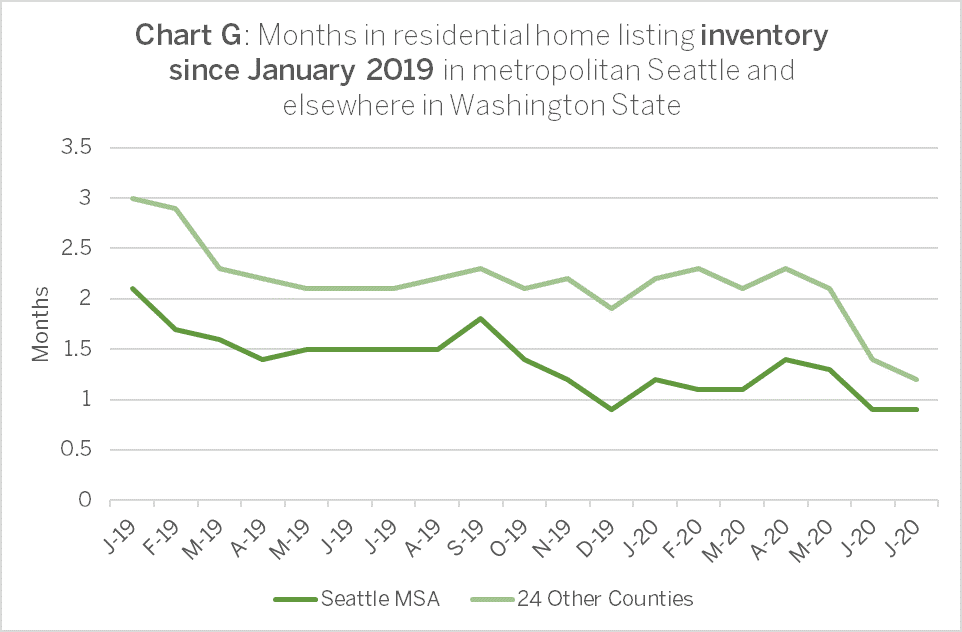

Durations of home inventories inside and outside of the Seattle MSA have since tightened to fewer than four and six weeks respectively by June 2020. The COVID-19 restrictions exerted little effect on this trend (Chart G). Locally originating demand for homes in all areas (urban, suburban, and exurban), together with demand arising from distributed working arrangements, require new construction to fill the gap. This presents yet another supply constraint that appears likely to drive new home prices even higher.

Supply shortages point to construction delays and higher prices

Nationwide demand for new homes has not subsided during the COVID-19 crisis. Yet in combination with demand for DIY home construction projects, as well as necessary repairs of damage from riots and looming autumn storms, the attendant demand for construction materials has led to a nationwide shortage of lumber. Exacerbated by low domestic production and tariffs on Canadian products, the yawning gap between supply and demand has pushed the price of lumber to record highs and depleted stocks, incurring lengthy delays.

Western S-P-F purveyors in the United States reported another crazy week of extremely limited availability as buyers desperately tried to cover their most pressing needs. Prices soared again and sawmills pushed their order files into late September, with delivery times extending into mid-October thanks to mounting rail car delays. Field inventories at all levels were depleted and secondary suppliers had little to offer for quick shipment …There was no pause in the insanity last week as Canadian Western S-P-F producers sold out every day before 8:00 a.m., leaving no cash wood available for customers in the U.S. Prices vaulted again, last week by an astounding $104 …, to US$850 and US$842 mfbm respectively.

For more details on the June 2020 Case-Shiller Index results, download the

S&P Dow Jones Case-Shiller summary report. For details on the market implications of our reports for homes in your neighborhood, contact a local RSIR broker.

Published by S&P Dow Jones, the Case Shiller Index surveys resales of residential homes in the Seattle MSA. The index notably does not account for condominium sales. “

S&P CoreLogic Case-Shiller Index Reports 4.3% Annual Home Price Gain in June,” S&P Dow Jones, New York, 28 July 2020.

Zillow Research,

Zillow 2020 Urban-Suburban Market Report, 12 August 2020; Andrew Chamings, “The 2020 San Francisco Exodus Is Real, and Historic, Report Shows,” San Francisco Gate, 15 August 2020.

The Associated Press, “U.S. Long-Term Mortgage Rates Rise; 30-Year at 2.99%,” reported in the Seattle Times, 20 August 2020.

Kéta Kosman, “

Softwood Lumber Prices Continue Rising as U.S. Home Building, Sales, and Prices Increase Sharply,” Madison’s Lumber Reporter, 25 August 2020. “S-P-F” is an acronym for “spruce, pine, and fir,” and refers to industry-standard grade lumber for “for single and multi-family home construction, commercial construction, crating and packaging, and furniture framing” (definition,

American International Forest Products). The acronym “mfbm” stands for “thousands of board feet.”